Water scarcity has the potential to increase the cost of water which makes operations more expensive and reduces profit margins. Water scarcity also limits availability, making it more difficult to access the water a business needs to operate which can decrease production and result in loss of revenue.

Water is undervalued, particularly in areas where water is most scarce. To date, water has also been easy to access and available. But the reality is changing. Decreasing water quantity and quality poses significant risks to businesses. Businesses need data and insights on water-related risks to better understand and internalize the full value of water at the site and enterprise levels.

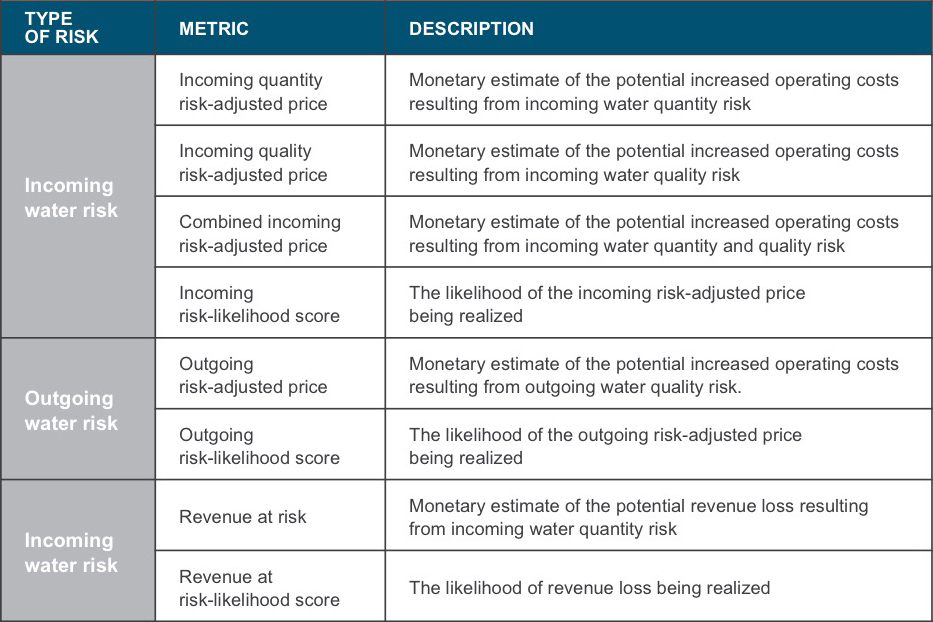

The Water Risk Monetizer uses best-in-class local water basin datasets, economic techniques and scientific methodologies developed by Trucost to monetize water-related business risks. The tool provides a comprehensive series of risk metrics to help businesses understand incoming (quantity and quality) risks and outgoing (quality) risks.

“The Water Risk Monetizer provides companies with a comprehensive tool to deepen their understanding of the financial implications associated with water risks. Tools like this can empower organizations to prioritize and invest in water conservation.”

–Paul Reig, Bluerisk

The tool takes user-provided business information on water use, water prices and production data and calculates incoming and outgoing water risk that could result in increased operating costs. The monetary value assigned to this risk take into account water availability, water quality and competing uses of water within local water basins across a three-, five- and 10-year time horizon. The Water Risk Monetizer also calculates the potential loss in revenue from incoming water quantity risk across the same time horizons.

Alongside each monetary value, the tool also calculates the likelihood of these costs being realized through a number of risk triggers including future water stress, and regulatory and reputational risk factors. The magnitudes and likelihoods are combined into an overall water risk rank so businesses can prioritize facilities for further assessment and start identifying appropriate risk mitigation strategies for each location to reduce their company’s overall risk profile.

Download a complete description of the methodology, including data sources and key assumptions and see below for a summary of outputs.

Water risk premiums

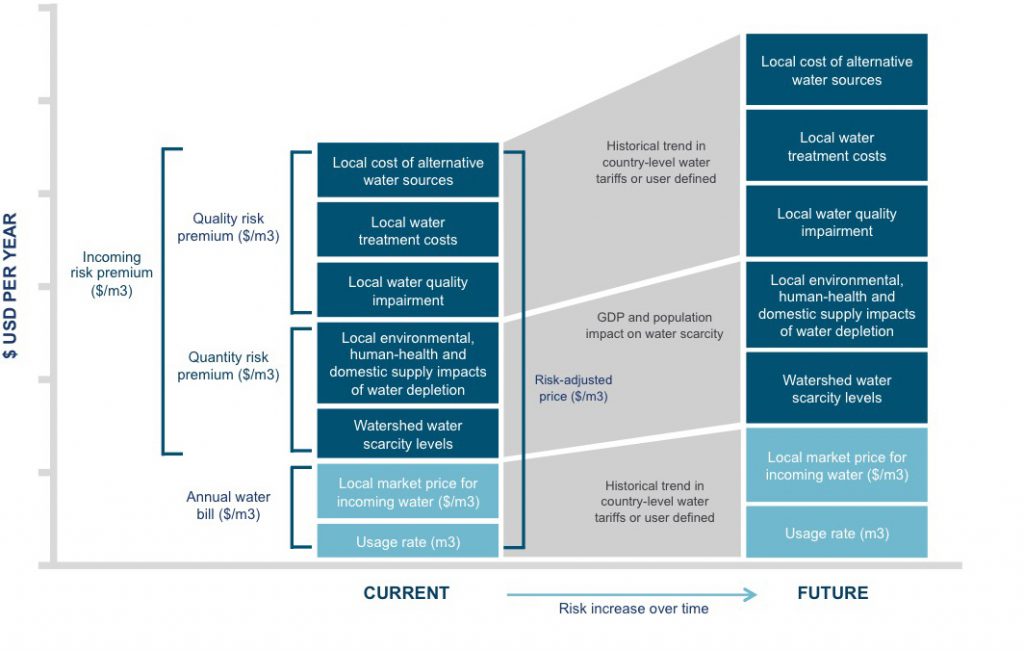

The incoming and outgoing water risk premiums are a monetary estimate of the increased price of water, which may be realized by a business as an increase in its operating costs. The water risk premium is calculated based on the full value of water to a facility, as estimated based on local water availability and local water quality.

Water withdrawal risk

Water withdrawal targets offer specific, time-bound metrics concerning what volume would be a sustainable allocation for a facility and consider critical contextual factors that are location-specific and informed by best available science and analysis. These contextual factors include the impacts of lack of water on ecosystems, human health, human consumptive needs, and economic and social water needs. A risk threshold of <40% is assumed to indicate a tolerable amount of water stress to a basin as defined by the World Resources Institute (WRI). Thus, operating in a watershed with a baseline water stress of less than 40% does not have water withdrawal risk as it is in a watershed with a sustainable rate of water withdrawal. Even if facility water withdrawal targets are met, that does not ensure the baseline water stress of a watershed is less than 40%. All users in a watershed must do their part to address water risk.

The water withdrawal risk levels are determined by the following parameters.

Incoming water risk premium

The incoming water risk premium is a monetary value of the local environmental, human-health and domestic supply impacts of water depletion and the future costs of incoming water treatment. Local water availability, water quality and population density are all variables that impact the size of the risk premium. Locations that have high levels of water stress (due to quantity or quality-related impacts) and high population densities will usually have a higher risk premium.

The Water Risk Monetizer considers both quantity and quality-related risk in its incoming risk assessment. The Water Risk Monetizer uses the Baseline Water Stress metric from the WRI’s Aqueduct Tool (WRI, 2019) to assess quantity risk and user inputs to assess quality risk.

Outgoing water risk premium

The outgoing water risk premium is a monetary value of the local environmental and human-health impacts of water pollution and the future costs of water treatment. Local water stress, water quality and population density are all variables that impact the risk premium. Locations that have high levels of water stress and high population densities will usually have a higher risk premium; however, the type of water pollutant and its treatment method will also influence the value.

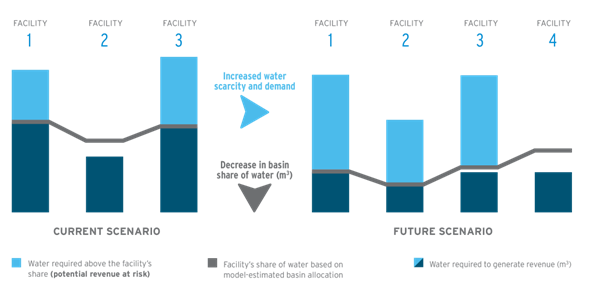

Revenue at risk: a context-based appraisal of water constraints to growth

Revenue at risk is a comparison of the estimated amount of water a business requires to generate revenue (cubic meters per USD of revenue) to the business’ share of water available in the water basin if water were allocated among water users based on economic activity (contribution to basin-level GDP). If more water is required than the basin share of water allocated, then a proportion of the business’ revenue is potentially at risk. Industry type, local water stress and competition (basin-level economic activity) are all variables that impact the amount of revenue at risk. Water-intensive industries located in areas with high levels of water stress and competition for water resources will usually have a higher amount of revenue at risk.

Download a complete description of the methodology, including data sources and key assumptions.